All About Export Business

Presentation

Cashback? Do we truly get the Cashback from the legislature?

Indeed, however not precisely the Cashback, but rather you will get the reward on the off chance that you send out the administrations outside India. The most extreme reward will be 5% with at least 3%. This is the fare impetus plan of the administration written in section 3 of Foreign Trade Policy.

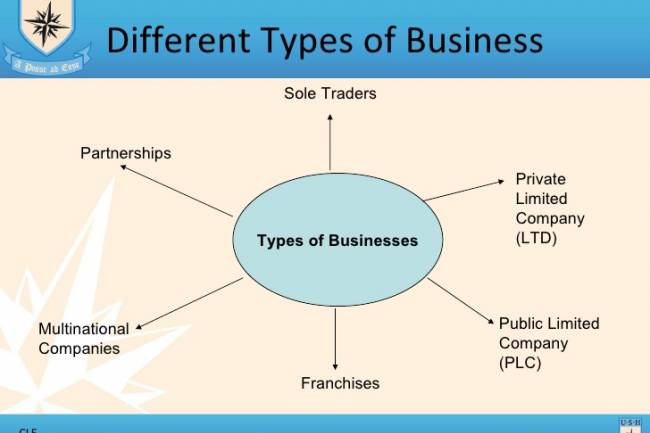

There are two sorts of fare from India conspire;

Stock Export from India Scheme (MEIS)

Administrations Export from India Scheme (SEIS)

In this article, we will discuss the SEIS plot for specialist organizations.

Idea OF SERVICES EXPORT FROM INDIA SCHEME (SEIS)

This plan has been acquainted by the administration with support the fare of certain told administrations. Promote another explanation for this is government boosted the fare to cover the infrastructural issues and different reasons.

CONDITIONS FOR SEIS SCHEME

Some time recently, you can tally upon this plan, ensure that you are qualified to utilize the plan and satisfy the accompanying conditions:

Just for Notified Services: The plan advantage is just stretched out to the advised administrations and not every other administration are secured under this definition.

Subsequently, check your administrations appropriately to profit the advantage.

Least profit from outside Exchange: This is one of the imperative criteria and condition for this plan. You ought to have earned net outside money of US$ 15,000 ($ 10,000 for sole proprietor or people) in past monetary year.

Net remote money implies Gross Earnings of Foreign Exchange less Total costs/Payment/settlements of Foreign Exchange by the IEC holder, identifying with benefit part in the monetary year.

Remote profit of Service segment just: If you are producer and specialist organization both, at that point outside money income of administration area might be considered with the end goal of advantage under this plan.

Type OF REWARD (CASHBACK) ON EXPORT

The reward might be as Freely transferable obligation credit scrips. These scrips can be utilized to pay the expenses like custom, benefit assessment, and extract obligation.

Further, on the off chance that you are not ready to utilize it, at that point you can pitch it to some other individual for money.

The most effective method to CLAIM THE BENEFIT UNDER SCHEME

In the event that you are secured under advised administrations and satisfy the above conditions then you can apply through the DGFT site by documenting the ANF 3B frame on the web. The procedure is for the most part on the web and one can document utilizing his advanced marks.

After accommodation, the correct officer might support the application after due check.

The most effective method to ACTIVATE THE DUTY CREDIT SCRIP

They obligation credit scrip can be enacted once it is enrolled with port in India. Once enrolled, it can be utilized on any port in India. Further, the scrip is substantial till year and a half from the date of issue of the scrip.

This legitimacy period can't be expanded.

CONCLUSION

When, you attempt it appropriately, you may discover numerous other viable issue, and that is the reason we are composing and sharing this article, so we can help you out if there should arise an occurrence of any issue or question.

Visit HireCA.com Now