How movement of Goods shall take place in India!

Presentation

We have perusing from quite a while that there will be free stream of development of merchandise under GST and a great many worker hours will be spared which are right now squandered on the fringes of the urban communities and states. Presently, this idea has been changed over into set of draft controls the administration and the entire strategy which was just a thought before has taken a state of reality.

The electronic way charge rules has been discharged by the administration and you ought to comprehend these standards to proceed with free stream of development of products once GST is set up from first July, 2017.

WHAT IS THE CONCEPT OF ELECTRONIC WAY BILL?

Electronic way bill (or e-way charge) is the new idea that requires each enlisted individual to outfit points of interest online before beginning of development of products.

At the end of the day, each enlisted individual who causes development of merchandise of transfer esteem surpassing fifty thousand rupees –

In connection to a supply; or

For reason other than supply; or

Because of internal supply from an unregistered individual,

Might outfit the data in PART An of FORM GST INS – 01 electronically before beginning of development of products.

The couple of focuses are likewise essential in such manner:

an) If the products are transported by the beneficiary of merchandise as the agent, regardless of whether in his own movement or a contracted one, at that point he should create the e-path charge by outfitting data in PART B of FORM GST INS – 01.

b) If the e-way charge isn't produced and merchandise are given over to the transporter, the enrolled individual should outfit the data identifying with the transporter in PART B of FORM GST INS – 01 and the transporter might create e-path charge without anyone else.

c) If the development of products is caused by unregistered individual either in his own movement or an employed one or through a transporter then he or the transporter create the e-way charge.

d) If the merchandise are provided by an unregistered provider to a beneficiary who is enrolled, the development should be caused by such beneficiary if the beneficiary is known at that specific time.

THE PROCEDURE OF E-WAY BILL FOR MOVEMENT OF GOODS UNDER GST

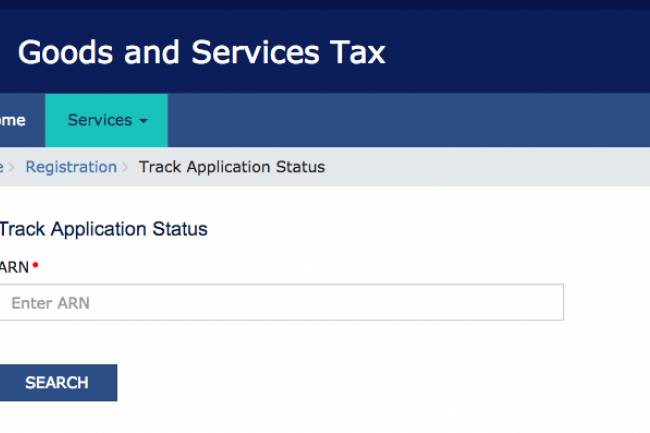

#Step 1 – Generate e-way charge: The initial step is to produce e-path charge as clarified previously.

#Step 2 – Generate interesting e-way charge number: After producing the e-way charge, a one of a kind e-way charge number (EBN) might be made accessible to the provider, the beneficiary and the transporter on the basic gateway.

#Step 3 – New E-way charge if method of transport is changed: The transporter who is exchanging products starting with one movement then onto the next over the span of travel should create another e-route charge on the regular entry. This must be done such exchange and further development of merchandise.

#Step 4 – Consolidated E-route charge for different transfers: Where various committals are expected to be transported in one movement, the transporter might demonstrate the serial number of e-way charges produced in regard of every relegation electronically on the normal entry and a united e-path charge in FORM GST INS – 02.

#Step 5 – Cancelation of e-way charge: Where an e-way charge has been created however the products are either not being transported, the e-way bill might be drop electronically.

#Step 6 – Validity of e-way charge: An e-way charge or a combined e-way charge created should be legitimate for the accompanying time frame:

Archives AND DEVICES TO BE CARRIED BY A PERSON-IN-CHARGE OF A CONVEYANCE

The individual accountable for a movement should convey the receipt and a duplicate of the e-way charge number.

Further, an enrolled individual may get a receipt reference number frame the basic gateway and create the same for check by the correct officer in lieu of the duty receipt which might be substantial for a long time.

Check OF DOCUMENTS AND CONVEYANCES

Any approved officer may catch any transport to confirm the e-way charge number in physical shape for all between state and intra-state development of products.

Visit HireCA.com Now